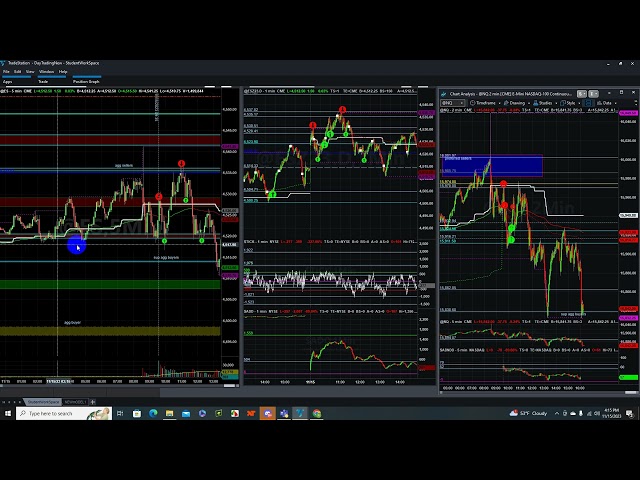

Learn to Trade E-Mini S&P 500, Nasdaq, Russell and Dow Futures with Trading Edge Intraday Price Levels (Support/Resistance Areas) – Jump start the learning by using Archival of 1000+ EOD educational videos and 257+ free youtube videos

I’ve heard from you. Day Trading is not an easy task especially when you are dealing with multiple future products like the E-Mini S&P 500 Futures (ES), Nasdaq (NQ), Russell (RTY) and Dow (YM) Futures. It is a complex job that requires analytical skills, instant decision-making abilities, along with:

- An ability to read the market from behind the chart (invisible stuff).

- Observing it through a contextual lens.

- Awareness of Key Price levels for the other 3 major indices (Day trading & Higher Timeframe Levels).

- Ability to identify Key Price levels for each market (Day trading & Higher Timeframe Levels) for minor/major bounce/reversals.

- Having a high-level understanding of Higher Timeframe, Medium Timeframe, and their bias/context for all 4 indices.

- Some foresight along with some intuition.

- Knowledge to perform an Intermarket Analysis when needed.

- Ability to summarize everything into an actionable day trading plan for the day in an easy-to-read format.

Each morning, I go through all of the above items and I spend time, thinking through all the possible scenarios for the day to come up with the initial trading plan for the day and then after open, i adjust it as day goes by. In the past, i used to write the summarized notes ( Trading Edge Day Trading Notes [Since 05/2019 – Archive of 1200+ Day Trading notes]. But now with computerized trading algos in place, i stopped writing a notes starting 2024 and decided to focus more on live intraday price action to help members. To further enhancing your learning, we have Archival of 1000+ EOD educational videos in our website and 257 free EOD videos in youtube (part of EOD notes).

Despite having all of this information, traders will still make mistakes during the day because the market is dynamic. Nothing is guaranteed in the market. We still need to evaluate the markets in real-time to see whether it is behaving according to the plan defined in the Trading Edge Day Trading notes. We also need to observe if the market is deviating from our plan or is it just chop/noise or even a trap. To help you with this, I will be with you live in a Discord Channel during LIMITED market hours to guide you with warnings and intraday read

Considering the vast amount of learning information available on the website & in the discord, I have also created a New Member Onboarding Guide to quickly onboard the new member in our ecosystem. You can review it here. New Member Onboarding Guide